BNB 101 – Everything You Need To Know About Binance Coin

Reading Time: 8 minutes

Imagine the Coca-Cola company had its own currency. And you could use this currency to buy Coke and other Coca-Cola products.

What would we call it? CNC? CAC? CCC?

Just before you start playing guessing games in your head, hollup. This article ain’t about the company that spreads happiness in a bottle.

In 2000, the largest cryptocurrency exchange company in the world announced the birth of its cryptocurrency—BNB.

In this article, you’re about to discover everything there is to know about BNB crypto coin. Sit tight, and let’s take you on a BNB journey.

But First…What is BNB?

BNB stands for “Build and Build”, and it’s a cryptocurrency unique to the Binance blockchain network. (more on that later)

It all started in 2017, when Binance had an ICO (Initial Coin Offering) crowdfunding event. During this event, Binance launched its own cryptocurrency—Binance Coin (BNB), almost at a giveaway price.

Binance put up 100,000,000 units of BNB for sale, a whopping 50% of the entire supply of BNB in circulation (200 million BNB coins), and at 15 cents.

Seems like a small price? At the time, yes. But three years later, in 2017, BNB went as high as over $600 per coin—making early investors overnight millionaires and, goddammit, even billionaires.

Binance raised about $15 million from the ICO, and a large part of the sum went into:

- Upgrading the Binance system

- Tightening the security

- Branding

…and educating the public about the platform.

The gist actually began in 2019, when Binance launched its native blockchain network—the Binance Chain (BC). Afterwards, BNB became the native coin of the Binance blockchain. Users that bought the ERC-20 tokens during the ICO in 2017 were given the new BNB coin.

Using Binance Coin: How Does it Work?

If you’re familiar with Ethereum, you know that Ethereum is the native currency of the Ethereum blockchain network.

BNB works similarly. It supports all fees on the Binance exchange platform, which means you can use BNB to cover transaction fees, listing fees, trading fees, and any other fees associated with the Binance platform. Initially, BNB was an ERC-20 token based on the Ethereum platform.

Binance Blockchain Network: The BNB Chain

Remember how we mentioned that the BNB gist started in 2019 when Binance launched its own native blockchain network? Good.

The Binance Chain is the first blockchain developed by Binance. It’s a standalone blockchain network that provides fast and secure trading of cryptocurrencies. However, the Binance Chain had some programmability issues, so the Binance Smart Chain (BSC) was developed.

The BSC helps carry out smart contract transactions or build smart-contract-based applications. (more on that later)

Later on, both Binance Chain and Binance Smart Chain were rebranded as the BNB chain.

The BNB chain offers the best of both worlds by providing faster transaction times and enabling developers to create DApps (decentralized applications) thanks to the smart contract functionality of the BSC chain.

The Ethereum Virtual Machine

Relax, it’s not a machine that takes you into the “Ethereum world.”

The Ethereum Virtual Machine (EVM) software enables developers to run smart contracts and DApps programs on the Binance blockchain. In simpler terms, the EVM is like a robot system that executes the code written by developers.

Think about it this way… it’s like the BNB chain infused the “essence” of the Ethereum blockchain into the BNB blockchain so that the BNB network can perform like Ethereum’s.

Smart Contracts

These are self-executing contracts with pre-established rules written in code. When specific conditions are met, these smart contracts automatically execute themselves.

Decentralized Applications (DApps)

DApps are applications executed on a decentralized network, meaning they don’t function or rely on a central authority or server.

Thanks to the EVM, developers have the necessary infrastructure to build, develop, and deploy smart contract applications and other decentralized applications like NFT marketplaces, Defi, and other Ethereum-based applications.

BNB Use Cases

While BNB was initially created as a utility token during the ICO and to discount trading fees, the coin has become more useful.

- BNB is used to settle transaction fees on Binance Chain, Binance DEX, and the Binance platform.

- You can partake in exclusive token sales with BNB.

- Also, BNB is accepted as a means of payment for goods and services in certain industries like Travel, Entertainment, and Finance. Specifically in organizations like HTC, Travala, Storm, Canva, Moeda, Monetha, crypto.com, etc.

BNB Wallets and Transactions

We can’t talk about BNB transactions without talking about BNB wallets, so here we go.

A BNB wallet is a digital wallet that holds your BNB coins. It helps you store and access your Ether. All BNB wallets have private and public keys.

A private key is your wallet password, which should always be kept private and secure. It’s just like your fiat bank account that has a password. Your private key gives you complete control and privacy over your BNB, and if leaked, you might forfeit your BNB to thieves.

On the flip side, a public key is your wallet address. It’s the “bank account” people send BNB to. Your address allows you to receive BNB deposits from others (like father christmas).

BNB transactions happen when you buy, sell, or store BNB, and a wallet helps you carry out these transactions.

BNB Mining

Hate to break it to you, but BNB cannot be mined. The coin has a fixed market supply in circulation, meaning all BNB coins have been predetermined, and no new coins can be added.

Now the question is, how do you get BNB?

If you recall, we mentioned that 200 million BNB tokens were minted during the ICO, and half of it was sold to investors. The remaining 100 million BNB tokens are available for sale to the public.

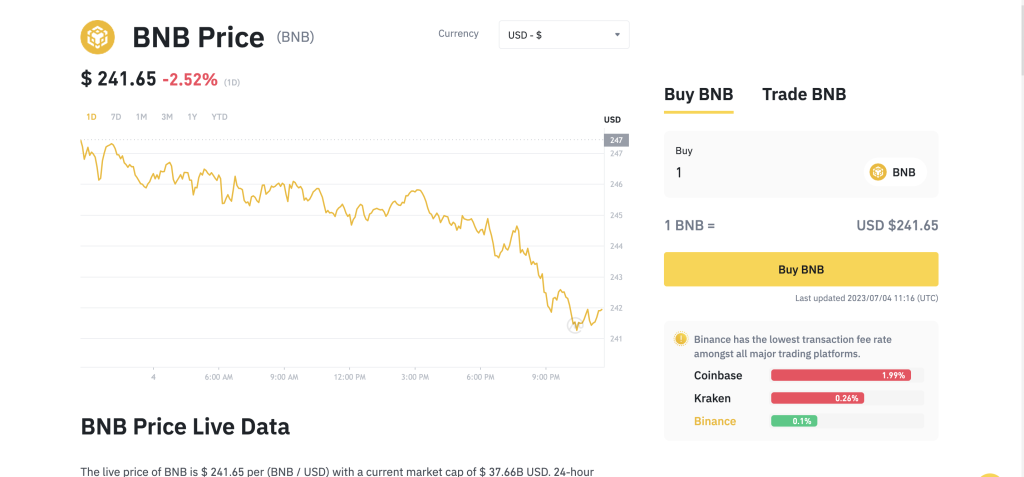

Investing in BNB: What Do You Need To Know?

Feeling up to it? Want to start investing in BNB? Here’s what you need to know.

Step-by-Step Process to Buy BNB

You can buy BNB on any cryptocurrency exchange platform that lists BNB and supports its trading. Here’s a step-by-step guide on how to buy BNB.

But first, it’s crucial to determine how much you’re comfortable investing in BNB.

1. Set up your crypto account

Choose your preferred (and reputable) exchange platform that supports BNB trading. Popular platforms include Binance, Kraken, BitFinex, and Coinbase.

2. Deposit funds

Next up the alley is to fund your crypto account. Most crypto exchange platforms accept local fiat currency. Also, if you have existing cryptocurrency like Bitcoin or Ethereum, you can use it to purchase the BNB.

After doing this, you can proceed to buy BNB.

3. Buy BNB

After funding your account, navigate to the market or trading section and search for BNB. If you use p2p on the crypto exchange, navigate to the market section and search for BNB. However, if buying directly from the platform, search for the BNB trading pair instead.

Popular pairs include. BNB/BTC, BNB/USDT, BNB/ETH, etc. You can easily convert the fiat you deposited into BTC, ETH, USDT, or whatever opposite pair.

4. Place a Buy Order

This next step applies if you’re buying on p2p or directly from the crypto platform. If buying directly from the platform, you can choose a market order (buying at the current market price) or a limit order (setting your desired price).

Afterwards, confirm your order, and they’ll be executed once the conditions are fulfilled. (remember how smart contracts work?)

5. Store your BNB

Voila! The BNB will be deposited into your BNB wallet on the platform. However, you can always move your BNB to a more secure wallet you control if you aren’t comfortable with the platform’s wallet.

Step-by-Step Process to Sell BNB

Want to sell your BNB for fiat? Or for another crypto? Then follow the following steps:

If you want to sell on the same platform you bought BNB on, log in to your exchange account. However, if you want to sell on another platform, you must first transfer the BNB to the platform’s BNB wallet.

Got it? Let’s move on.

1. Connect Your Fiat Bank Account

Remember how you deposited funds into the crypto exchange platform? The same concept applies here. You’ll need to link a fiat account to receive fiat for your BNB. However, if you’re doing p2p, you can send the buyer your fiat bank account details.

However, this step only applies if you’re selling your BNB for fiat. If otherwise, maybe for another crypto, you can skip this step.

2. Place a sell order

Confirm the amount of BNB you want to sell, and review the order details.

3. Withdraw funds

The good part, innit? After selling the BNB, you can withdraw funds from your fiat wallet (if the exchange platform has one), or directly withdraw into your preferred bank account.

However, kindly note that these steps are general guidelines, and the procedures may differ slightly, depending on your exchange platform. When buying or selling BNB, always exercise caution and review your orders carefully to avoid stories that touch.

Risks and Benefits of Investing in Binance Coin (BNB)

Thinking of investing or using BNB? Here are the crucial factors to consider:

Benefits of Investing in BNB

- Utility Within the Binance Ecosystem

BNB is quite useful within the Binance platform. You can use it to:

–Access exclusive features.

–Pay for trading fees on the Binance exchange (and get some amazing discounts).

–Participate in token sales, and many more.

This widespread adoption and utility of BNB increases its demand, thereby increasing its value.

- Limited Supply

Unlike fiat, or other cryptocurrencies that can be minted as needed, BNB has a limited supply in circulation. Plus, Binance conducts regular periodic burns to remove more BNB in circulation, thereby increasing scarcity and the value of BNB for existing investors.

Risks of Investing in BNB

- Dependency on Binance

As much as Binance has tried to “dissociate” from BNB, the fact remains that BNB’s value depends on the success and reputation of the Binance exchange. This differs from other cryptocurrencies with an “independence” from any crypto exchange.

If Binance was to face regulatory or operational issues, it could potentially affect the value of BNB. This poses a valid risk if your portfolio is heavily focused on BNB.

Plus, the success of BNB is also reliant on Binance’s ability to stay competitive and maintain its top position in the crypto market.

- Market volatility

Just like other cryptocurrencies, BNB’s price can be quite volatile. The value of BNB often experiences significant fluctuations, so if you have a low-risk tolerance, it’s advisable to only invest an amount that wouldn’t “scar” you.

On a final note, always conduct detailed research before using or investing in BNB. All cryptocurrency investments come with inherent risks, so, always seek professional advice before making investment decisions is better.

Conclusion: What Does BNB Hold for the Future?

Over the years, Binance coin (BNB) has proven to be a significant player in the crypto industry, and without a doubt, great potential lies ahead for the coin.

BNB holds many opportunities for users and investors alike. As long as Binance continues to be a major crypto exchange, the value of BNB will continually be on the rise. If Binance continues to attract new users, foster new applications, or launch new services, it’ll positively impact the BNB coin and system.

However, just like any cryptocurrency, it is essential to approach BNB investment with caution.

Cryptocurrencies are subject to inherent risks, market volatility, and regulatory uncertainties. Always do thorough research, diversify your investment portfolio as required, and weigh your risk appetite before putting any amount into BNB.

May the crypto gods be kind to you. WAGMI!