USDC 101 – Everything You Need To Know About USDC

Reading Time: 7 minutes

Heard of USDT?

Then USDC should be no stranger to you.

But if you haven’t, here’s your cue to learn about USDC — a stablecoin pegged to the US dollar.

Grab a snack or two, and let’s walk you through all you need to know about USDC.

Let’s go!

About USDC

If Celine Dion and Chris Hemsworth had a one-night stand, what would we call that baby?

Cech? 👀

Okay, just kidding.

Let’s bring it back to USDC.

USDC is the brainchild of Coinbase (a popular crypto exchange) and Circle (a fintech company). In May 2018, these two companies came together to create USDC, a stablecoin that’ll offer stability and facilitate fast transactions.

In its literal meaning, USDC means USD coin.

USDC is a cryptocurrency created to maintain a stable value, compared to the volatility of other cryptocurrencies. To achieve this, USDC is pegged to the United States dollar (USD).

USDC is just like any other cryptocurrency.

It can be used as a store of value, and for fast and secure transactions. It also mitigates the price volatility commonly associated with other digital assets like Bitcoin or Ethereum.

Each USDC coin is backed by an equal amount of US dollars held in reserve, often in a bank account. With this backing, the value of USDC remains close to the US dollar’s, providing users stability and predictability.

Using USDC: How Does it Work?

Digital USD coin? How is that meant to work?

Hold on tight; you’ll soon discover how.

Blockchain

A blockchain network is an open-source, decentralized digital ledger that verifies, records, and stores financial information across multiple computers or nodes.

A blockchain network is the underlying technology behind all cryptocurrencies. It’s what makes cryptocurrencies decentralized and transparent.

In a blockchain network, transactions are grouped in blocks and linked in a chronological and immutable chain. Once a transaction is confirmed, it’s added to a string of blocks.

Each block contains a hash (unique identifier) and a link to the previous block, creating a continuous chain of blocks. This process ensures the security of the data stored on the blockchain network.

Most cryptocurrencies have their own blockchain. However, (USDC) does not have its own blockchain. Being an ERC-20 token, it ‘borrows’ the Ethereum blockchain. Meaning, USDC operates on the Ethereum blockchain and benefits from all its features.

However, USDC also operates on the Stellar, Algorand, and Solana blockchains. This multi-blockchain functionality enables users to use USDC on various blockchain networks.

USDC Mining

USDC is not created through a mining process or consensus mechanism, unlike other conventional cryptocurrencies. It operates through a centralized issuance process known as minting.

USDC coins are created and issued by “USDC issuers.” These regulated financial institutions mint new USDC coins and maintain the necessary reserves to back the coins.

While this concept deviates from the decentralized concept behind cryptocurrencies, it reassures users that a corresponding US dollar reserve backs each USDC coin. However, regular audits are conducted to ensure that the institution is fully transparent.

USDC Explorer

An explorer provides real-time information about the blockchain network. Remember that a blockchain network is open-source and decentralized?

You need a blockchain explorer to use the open-source feature of the blockchain.

Bringing it back to USDC…

You can track all USDC transactions on any blockchain it operates on, with an explorer. These transactions include wallet balances, movement of tokens, transaction details, etc.

However, USDC doesn’t have its explorer. As an Erc-20 coin, you can use Ethereum blockchain explorers to extract information about USDC transactions and addresses.

Such Ethereum explorers include:

- Etherchain

- Blockchain

- Etherscan

- Ethplorer

…and many more.

USDC Wallet

USDC transactions happen when you send or receive USDC from one wallet to another.

Without a USDC wallet, you can’t carry out transactions on the blockchain network. (even for any cryptocurrency)

A USDC wallet helps you store, send, and receive USDC in the crypto ecosystem. It’s what allows you to interact with the USDC network.

A USDC wallet comes with a unique address for each user. It can be likened to a type of “bank account” to receive USDC.

This address is often a long string of alphanumeric characters. To receive USDC coins, all you have to do is share this address.

Popular types of wallets include:

Software wallets – digital wallets installed on mobile devices and computers.

Hardware wallets – physical or offline crypto wallets designed for more secure storage.

Investing in USDC: Here’s What You Should Know

Want to start investing in USD coins? Come closer; let’s tell you what you need to know.

Benefits of Investing in USDC

-

Defi Compatibility

USDC is widely used for decentralized finance (DeFi) protocols and applications. It can be adopted for yield farming, used as collateral, or borrowed in liquidity strategies within DeFi platforms. This is a major perk for investors.

-

Liquidity

USDC is a widely traded stablecoin in the cryptocurrency ecosystem. Several crypto platforms support its trade. This gives it high liquidity, making it super easy to convert USDC into fiat currencies and other cryptocurrencies.

-

Stability

A major advantage of USDC is that it maintains a stable value relative to its underlying reserve asset — the US dollar. This stability is a sweet spot for users to avoid the volatility of other cryptocurrencies.

-

Accessibility

USDC is available on several blockchain networks like Ethereum, Solana, Tron, EOS, and Algorand. This availability on multiple blockchains makes USDC easily accessible, allowing users to choose their preferred blockchain network.

-

Hedging

Whenever other cryptocurrencies have heightened price fluctuations, users can easily use USDC to hedge. This means that they convert their assets into USDC to preserve their value and avoid potential losses.

Risks of Investing in USDC

-

Centralized Control

USDC goes against decentralization — the underlying principle of crypto. The issuing company holds some degree of centralized control over the coin. This can become dangerous if the company ever goes haywire.

-

Systemic Risks

The cryptocurrency market, at large, can impact the value of USDC.

With extreme market volatility or systemic risks, USDC can face challenges maintaining its liquidity. The overall stability of the crypto ecosystem can indirectly impact the value and performance of USDC.

-

Regulatory Risks

The regulatory landscape for stablecoins is constantly evolving and subject to future changes. USDC is not exempted. Restrictions imposed by global authorities can affect the value and usability of USDC.

How to Buy USDC: A Step-by-Step Guide

Want to start buying and selling USDC? Here are the steps to follow.

1. Evaluate Your Risk Affinity

A rule of thumb in investing is only to invest an amount you can do without. Before you start investing in USDC, consider your risk appetite. How much are you comfortable investing? Once you’re sure how much you want to invest, proceed.

2. Choose A Reputable Crypto Exchange Platform

Crypto exchange platforms provide you with the opportunity to invest in any cryptocurrency. Popular ones include Binance, Coinbase, BitFinex, Kraken, etc.

3. Fund Your Crypto Exchange Account With Fiat

Now that you’ve chosen an exchange platform, you can fund the account with fiat. The good thing is most crypto exchange platforms come with a fiat wallet, enabling you to transfer money to the platform and buy your preferred cryptocurrency.

4. Buy USDC

After funding your crypto fiat wallet with the amount you’re willing to invest, proceed to buy.

Navigate to the market section and search for USDC. But if you’re buying directly from the platform, simply search for the USDC trading pair instead.

Popular pairs include USDC/BCH, USDC/ETH, USDC/BTC, etc. You can also convert the fiat in your account into BTC, ETH, USDC, or your preferred opposite pair.

5. Place a Buy Order

This next step only applies if you buy on p2p or directly from the crypto platform.

If so, choose a market order (buying at the current market price) or a limit order (setting your desired price).

6. Store your USDC

Once you place your buy order and it’s confirmed, the USDC will be deposited into the platform’s USDC wallet. You can leave it on the platform or transfer it to a more secure wallet.

How to Sell USDC: A Step-by-Step Guide

Want to sell your USDC for fiat or another cryptocurrency? Follow these steps.

PS: You can sell USDC through p2p (peer-to-peer), i.e., within users in the platform, or sell to the crypto exchange itself.

If you want to sell on a different platform, you must first transfer your USDC to the platform’s USDC wallet.

Now let’s get into the process.

1. Choose A Reputable Crypto Exchange

Choose your preferred crypto platform to sell your USDC, and move on to the next step.

2. Connect Your Fiat Bank Account

If you aren’t selling for fiat, you can skip this step.

If you’re selling your USDC for fiat, you have to link a fiat account to the crypto platform. The account is where your fiat will be deposited into.

However, if you’re selling through p2p, you can send the buyer your fiat bank account details.

3. Sell Your USDC for Fiat

If selling directly to the crypto exchange, navigate to the “market” or “sell section” to sell USDC for your preferred currency. Confirm the amount of USDC you want to sell, and review the order details.

4. Withdraw your Funds

Once you place the sell order and it’s confirmed, the fiat will be deposited into either your fiat wallet or your given account details.

If deposited in a fiat wallet, you can withdraw the fiat into your preferred bank account.

Conclusion: USDC and the Future

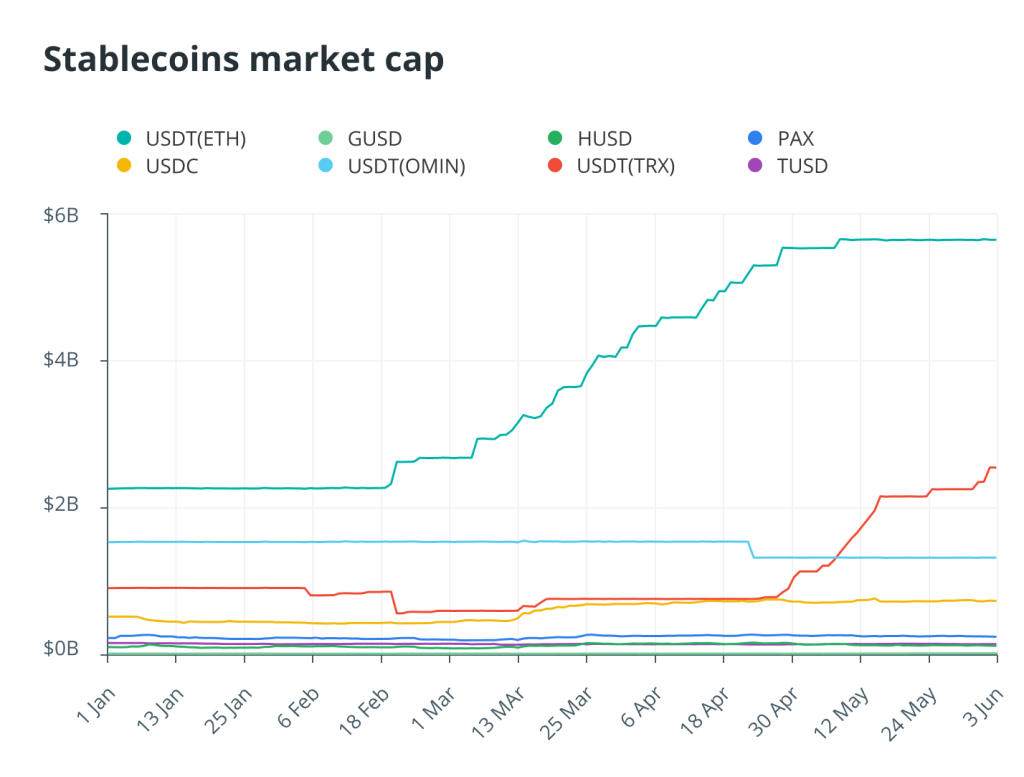

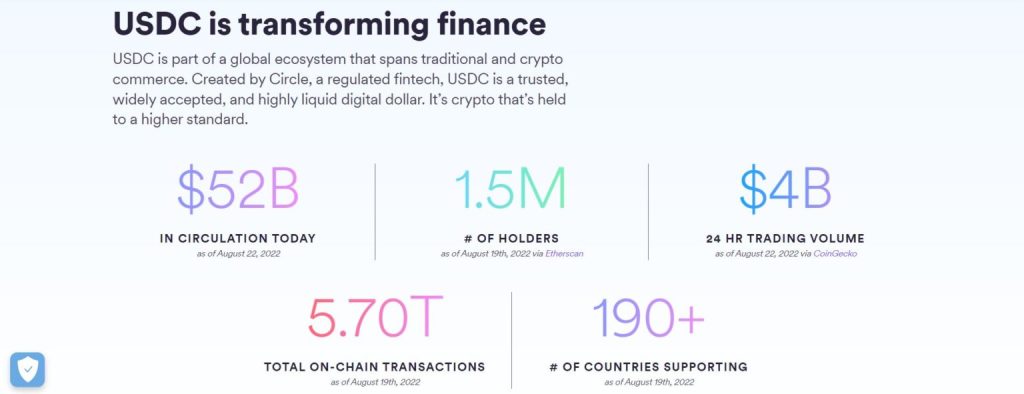

USDC has come a long way since its inception in 2018. In no time, it has become a widely adopted stablecoin in the crypto ecosystem.

USDC’s stability and regulatory compliance make it an attractive choice for those seeking a stable means of exchange.

As we look towards the future, USDC’s potential knows no bounds.

Its growing integration within financial sectors indicates its potential to become a core foundation of the digital economy.

As more users, businesses, DeFi applications, and protocols adopt USDC, we can anticipate a significant increase in its global acceptance and value. And as we witness ongoing changes in the digital economy, USDC is poised to play a pivotal role in shaping the future of finance.

Keep your fingers crossed! 🙂