ETH 101 – Everything You Need To Know About Ethereum

Reading Time: 9 minutes

Unless you’ve been living under a rock, you probably know what Ethereum is, or at least, you must’ve heard the word somewhere. But if you’ve been living under a rock (like Mount Augustus), then you probably don’t know what Ethereum is.

Fear not; we’ll reveal everything you need to know about Ethereum.

By the end of this article, you can shout from your rooftop rock and say, “I’m an Ethereum guru now; you can’t stop me.” (P.S: We won’t be held responsible for anything that happens after.)

Ready? Now let’s dive in.

About Ethereum

Ethereum came to life in 2013—when Vitalik Buterin, a renowned programmer and developer, proposed a platform that could allow for decentralized transactions. This idea caught the eye of major investors, who then crowdfunded the idea. In 2015, the Ethereum platform was established.

But what does Ethereum mean?

Ethereum is a decentralized platform on the blockchain network that creates a peer-to-peer system, which securely executes smart contracts.

Hollup. Now you’re probably thinking… “what the heck is that“? Think of it this way… let’s assume Ethereum is the name of a community, platform, or network. Darn, let’s even call it the name of ‘a country on the internet.’

When you think of a community, platform, or country—there should be a leader, right? Like, the person that governs the activities of the community. But in Ethereum this country on the internet, there’s no “leader.” It’s decentralized, meaning there’s no “central” authority where power is concentrated. Instead, power is with everyone in the community.

Using Ethereum: How Does It Work?

Oh wow. How is there a ‘country on the internet’ without a “leader”? How would things be orderly? Good question. This is possible thanks to cryptography, a technical process that secures every transaction on the blockchain.

Blockchain

The Ethereum technology is built on the blockchain—a set of records stored in a spread network of single computer nodes distributed worldwide. Every participant in the blockchain network creates individual records, which are then compared with other records and made public. So, no two participants can have the same records.

Now back to Ethereum, our country on the internet. A country should have its own currency, yeah? That’s right. The native token of the Ethereum blockchain network is Ether (ETH) — used to cover transaction fees on the network. However, many people usually refer to Ether as Ethereum.

Smart Contracts

The Ethereum platform powers several applications, and smart contracts are at the core building blocks of these applications.

A smart contract is a program or activity that runs on a set of pre-existing agreements. Smart contracts convert agreement terms into computer codes that automatically execute—once the agreement terms are met.

It’s like: if X happens, then Y follows. If X doesn’t happen, then J follows. You get?

Or…think about a vending machine. You choose a product, the machine tells you the amount of the product, you put in some cash, the machine confirms it’s the correct amount, and voila! It dispenses your desired product.

Ethereum Mining

Now, how do we get Ethereum? It doesn’t fall from the sky, does it? Absolutely not. Like fiat is “printed”, Ethereum is “mined.”

Ethereum mining does two things:

- It helps secure the Ethereum blockchain network from hacking or false transactions.

- It creates Ether, making miners profitable.

So, the question of the hour is: how does mining work?

Ethereum mining is the process of creating, adding, and verifying transaction blocks to the blockchain network. This means the miners must approve every transaction in the Ethereum network.

This approval process is known as the proof-of-work, and it’s done using a hashing script (ethash) to solve the validity of the blocks of transactions.

Let’s break it down.

Every Ethereum transaction produces a unique hash. A large collection of these “unique hashes” creates a “block” on the blockchain network, known as the “block’s hash.” This block contains a long string of information (from the large collection of Ethereum transactions that eventually make up the block).

The mining process is when a miner (using a strong computer) accurately guesses the block’s hash, and the blockchain network rewards the miner with new Ethereum coins (Ether) as compensation.

Ethereum Explorers

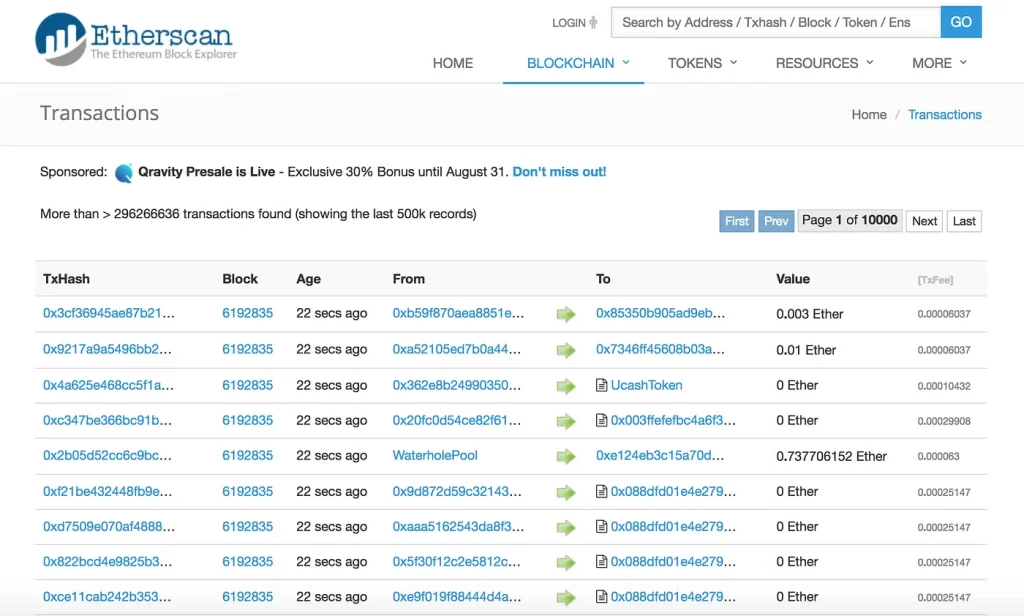

Since Ethereum is decentralized and open source, anyone (from anywhere), can view everything that’s happening or that has happened on the Ethereum blockchain.

Ethereum block explorers are your gateway to everything about Ethereum’s past and present data. An explorer provides you with real-time data and information on Ethereum’s transactions, miners, blocks, gas fees, and other blockchain activity.

Other data accessible with Ethereum explorers include:

- Hash rates

- Miners address

- Number of transactions

- Transaction timestamps

- Ethereum account addresses

- The difficulty of mining a block

- Gas fees consumed per each transaction

- The total value of Ethereum in an account

Block explorers are particularly useful for checking transaction history, which comes in handy if you’re an active trader of Ether. With an Ethereum explorer, you can easily confirm if someone has received Ethereum.

Popular Ethereum explorers include:

- Etherchain

- Etherscan

- Explorer

- Ethstats

- EnjinX

- Epirus

- Otterscan

Ethereum Transactions and Wallets

Think of this scenario. You’re a fisherman hunting for fish in an ocean. With your canoe and fishing net, you’re able to get some fish for yourself.

Now, let’s return to the present moment (got you daydreaming about some savoury fishes, innit?).

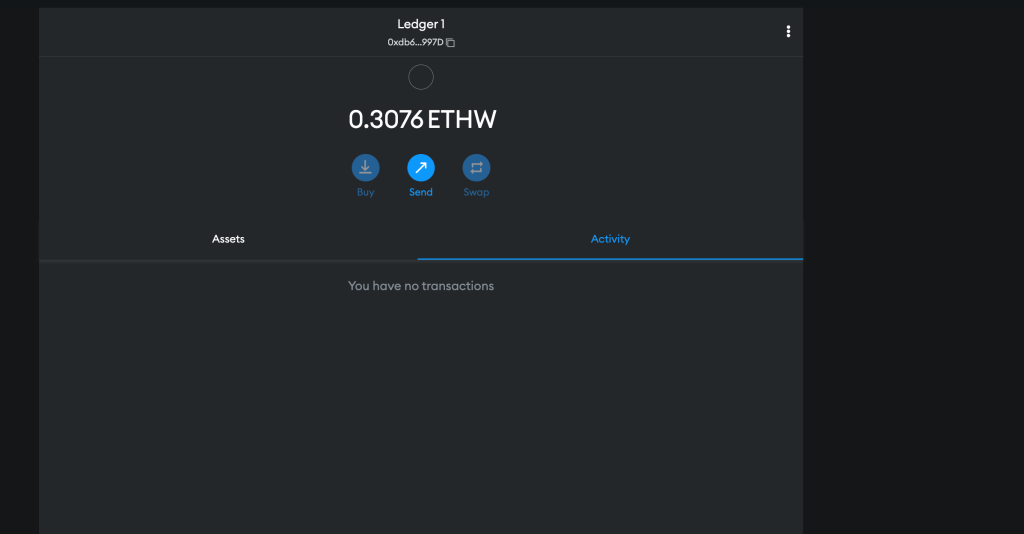

Like the fisherman that catches fish with a canoe and fishing net, your Ethereum wallet allows you to carry out Ethereum transactions: buy, sell, and store Ethereum.

An Ethereum wallet is like a digital safe that houses your Ethereum. It helps you store and access your Ether.

All Ethereum wallets have private and public keys. A private key is your wallet password, which should not be available to anyone except you. It gives you total control over your Ethereum, and if leaked, you risk losing your Ether to hackers. It’s just like your fiat bank account that has a password.

On the other hand, a public key is your wallet address, which you send to people to receive Ether from them. It’s just like giving people your bank account number so they can send you money.

Simply put, you make Ethereum transactions when you buy, sell, or receive Ether. And a wallet helps you carry out these transactions.

Advantages Of Using Ethereum

1. Accepted Form Of Currency

In most parts of the world, Ether, the native token of Ethereum, is accepted as a means of payment for goods and services. This is a solid advantage because Ethereum broadens the scope of payments and trade worldwide.

As a worker in Asia, you can get paid from another continent, like America, Asia, or Europe, without being paid in your country’s currency. Ethereum offers a global means of payment.

2. Fast Transaction Speeds

Ethereum has a high processing speed and can process up to 30 financial transactions per second, with Ethereum 2.0 said to increase this up to 100,000 transactions. Financial systems that incorporate the Ethereum network will enjoy fast transaction times.

3. Decentralization:

As an open-source network, nothing is hidden on the Ethereum blockchain network. It maintains full transparency; anyone using the platform can get real-time data on past and present transactions.

4. Smart Contracts

The concept behind smart Contracts can be implemented into any system or network. For example, consider a simple contract agreement between two business owners. If one party fulfils, the agreement stated, Y happens.

However, a lawyer has to validate if the agreement has been fulfilled. Smart contracts eliminate the need for the “lawyer” by validating the pre-existing conditions by self. Smart contracts reduce the need for physical bodies of regulation.

Disadvantages of Using Ethereum

1. Gas Fees and Energy Demands

Ethereum gas fees are increasing by the day, and the energy used to mine blocks can cause serious climate effects. If the energy levels aren’t regulated or reduced, Ethereum poses severe climate threats to the environment.

2. Scalability Issues

Unlike other cryptocurrencies that serve a single function (as a payment method), Ethereum takes on many roles. This includes a platform for smart contracts, DeFi Finance, NFTs, and many more. This can make the Ethereum network congested, prone to certain hacks, loopholes, and breakdowns.

3. Difficult Programming Language

While this is not a major issue or disadvantage, it poses a growing concern for developers interested in the Ethereum network. Ethereum’s native language—Solidity, isn’t the easiest to learn (especially if you’re new to blockchain development) — compared to other programming languages like C++, Java, or Python. In addition, there aren’t many beginner-friendly lessons out there.

4. Investments and Regulation

As a decentralized cryptocurrency, Ethereum needs to be more regulated. You can own as many Ethereum as you want without background checks or proof of funds. This makes it easy for Ethereum to promote criminal activities without being able to trace the identity of fraudsters.

Investing in Ethereum: What You Should Know

As with any valuable digital currency, Ethereum can be invested and stored as an item of value. But how do you go about the process?

How to Buy Ethereum: A Step-by-Step Guide

Depending on the part of the world you’re in, you can buy Ethereum directly from your wallet or a verified crypto exchange platform.

To buy Ethereum:

1. Ascertain Your Risk Appetite:

The first step is to weigh your risk affinity. How large or small are you willing to go? As the rule of thumb in investment, you should only invest an amount you’re willing to lose, or an amount your life doesn’t depend on. After ascertaining the quantity of Ethereum you’re willing to buy, you can move on to the next stage—choosing a verified crypto exchange.

2. Choose A Verified Crypto Exchange Platform

A crypto exchange platform allows you to buy and sell any cryptocurrency. Global crypto exchange platforms include Binance, Coinbase, Kraken, BitFinex, etc. Some crypto exchange platforms also offer wallets to help you store your Ethereum.

3. Fund Your Account On The Crypto Exchange Platform

Just like depositing money into your bank account to buy goods and services, you’ll also need to fund your crypto exchange account to buy Ethereum. Once this is done, you can proceed to buy your Ethereum.

4. Buy Your Preferred Amount of Ethereum

Unlike stocks or ETFs, you can buy Ethereum at any time of the day — even at ungodly hours. To buy Ethereum, navigate to your crypto exchange platform’s “buy” or “market” section, enter the ETH symbol, and input the quantity you wish to buy.

How to Sell Ethereum: A Step-by-Step Guide

You may sell your Ether in exchange for fiat or as a payment method for goods and services. You can sell Ethereum through p2p (peer-to-peer), i.e., within users in the platform, or sell to the crypto exchange itself.

If you’re selling your Ethereum for fiat, these are the steps to follow:

1. Choose A Verified Crypto Exchange

Like the first step in buying, you must choose a preferred crypto exchange to sell your Ethereum.

2. Link Your Fiat Bank Account

For some crypto exchanges, you’ll need to connect your local currency bank account—to the platform. And for other p2p platforms, you only have to send your bank account number to the buyer.

3. Transfer Your Ethereum to the Crypto Exchange Platform

If you have Ethereum outside the crypto exchange platform, you must first transfer the Ethereum. If the Ethereum is already on the platform, then you can skip this step.

4. Exchange Your Ethereum for Your Preferred Currency

Now it’s time to sell. If selling directly to the crypto exchange, navigate to the “market” or “buy section” to sell the Ethereum against your preferred currency. If selling via p2p, navigate to the p2p section. Note that you’ll have to pay some tiny amount to cover gas fees to process the transaction.

5. Withdraw the Fiat Into Your Bank Account

Once you exchange the Ethereum for your preferred currency, you can withdraw the fiat into your added bank account.

Risks And Benefits Of Investing In Ethereum

Investing in Ethereum can be quite profitable, especially when you make informed financial decisions. Depending on the market price you buy Ethereum at, you can get a healthy ROI whenever the price moves past your entry point.

On the other hand, investing in Ethereum can be dangerous as well. Ethereum is volatile, and price surges can wreck your entire portfolio. Ether price movements have fluctuated a lot over the years, leaving some investors weeping and others overnight millionaires.

Investing in Ethereum should never be based on assumptions, but on informed decisions based on proper market analysis.

Ethereum and the Future

Ethereum promises an exciting future, which is seen in some areas like:

1. Decentralized finance (DeFi):

As an open-source network, Ethereum will facilitate trading, borrowing, lending, and investing at large without a central authority. This will make the finance industry more trustworthy without heavily relying on centralization. We’ll witness more DeFi platforms come out to play with a growing amount of users.

2. Enterprise Adoption:

Large corporations and companies will leverage the Ethereum network to build more decentralized applications, products, and services. It’s already happening in countries like Switzerland, Japan, China, Argentina, and many more.

3. Non-Fungible Tokens:

While NFTs are here already, we’ll see an increase in digital assets built on the Ethereum blockchain, and even better, with Ethereum 2.0 coming to play.

However, this “future” does come with some challenges.

- As users on the Ethereum network carry out more transactions, the existing infrastructure needs to be able to keep up. With more users on the platform, the network can become more congested and have slower transaction times, posing a scaling difficulty.

- Also, being decentralized, Ethereum is liable to malicious attacks from con artists looking to exploit the network’s vulnerabilities. In 2016, the DAO hack led to the loss of millions of dollars in Ether.

- Ethereum mining uses a huge amount of energy, which contributes to climate change and threatens our environment if not properly managed.

Wrapping Up

Well, well, we do hope you’re an Ethereum guru by now.

Ethereum remains a powerful and highly-sought after cryptocurrency till today. It holds limitless potential for the future, so if you’re looking to join the revolution, Ethereum is worth keeping tabs on.

Ethereum is already being incorporated into major technological advancements, with more ground-breaking developments to come.

And who knows, maybe someday, we’d all be paying for groceries with Ether. Until then, let’s make a toast to Ethereum. Cheers!