BUSD 101 – Everything You Need To Know About Binance USD

Reading Time: 6 minutes

Buss it, buss it, buss it…

If you’re a fan of Erica Banks, you might assume BUSD is the acronym for that viral song, buss it down (that had everyone bussing it down on social media).

Hate to burst your bubble, but it’s not.

BUSD is a stable crypto coin birthed by Binance and Paxos (more on that later). And in this article, we’ll take you through all you need to know about the BUSD coin.

You ready? Let’s bussd it get into it.

About BUSD

It all started in 2019 when Binance and Paxos created a stable cryptocurrency, known as BUSD.

Pro tip: Binance is the largest cryptocurrency exchange platform, while Paxos is a regulated financial institution for digital assets.

But then, what exactly is BUSD?

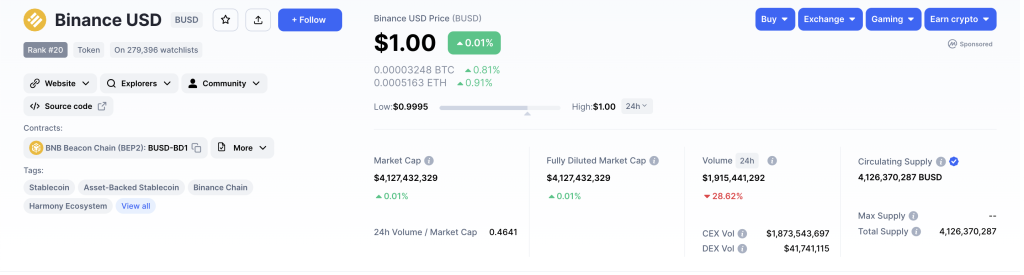

BUSD is a stablecoin (more on that later) that is pegged and backed by the value of a US Dollar, which means 1 BUSD = $1.

How is this possible?

That’s where Paxos’ regulation comes in. Paxos holds an equivalent amount of USD to the total supply of BUSD. Meaning BUSD fluctuates directly with the price of USD.

Using BUSD: How Does it Work?

How is BUSD “stable”, and how does the coin work?

Stablecoins

Generally, the concept of cryptocurrency is – being decentralized and not controlled by a central authority.

However, unlike fiat, cryptocurrency can be quite unstable. So, what if there was a way to make crypto stable?

Enter stablecoins—cryptocurrencies whose values are attached to fiat currencies like the US dollar. And an example of that, is BUSD.

Getting clearer now?

Stablecoins are gaining more recognition today as a more stable alternative to crypto. They have no volatility, as opposed to cryptocurrencies like Bitcoin or Ethereum. There are three widely known stablecoins today, which include BUSD (Binance USD), USDT (Tether), and USDC (USD Coin). Each of these stablecoins have a value equivalent to 1 USD.

Ethereum and the Binance Chain Network

The BUSD coin is hosted on the Ethereum blockchain network. Hence, BUSD transactions are processed via Ethereum smart contracts, without the need for any central authority. BUSD can can be used on the Ethereum and Binance Chain networks, and accessed as an ERC-20 or BEP-2 coin.

BUSD Minting and Burning

Unlike other cryptocurrencies, BUSD cannot be mined—because it is pegged to the US dollar. Instead, BUSD is minted.

To understand how minting works, we’ll need to understand the roles of Paxos and Binance.

Paxos is a regulated financial institution that issues digital assets. It’s like the escrow holding the USD reserves that back BUSD coins.

On the flip side, Binance manages the BUSD token and is responsible for the minting and burning of BUSD stablecoins.

BUSD minting is the process of creating new BUSD stablecoins. This happens when users deposit fiat into their crypto exchange accounts to convert them into BUSD. And when this happens, Paxos deposits US dollars into the reserve (through smart contracts), and the newly minted BUSD coins are sent to the customer’s wallet.

On the flip side, BUSD burning happens when users redeem their BUSD for USD. Unlike other cryptocurrencies mined through proof of work, BUSD’s mining is directly tied to the deposits and withdrawals of US dollars on crypto exchange platforms.

BUSD Wallets and Transactions

You carry out BUSD transactions when you buy or sell BUSD.

And like any other cryptocurrency, you need a BUSD wallet to buy, sell, and store your BUSD. It’s similar to a regular fiat bank account that allows you to hold your US dollars. In this sense, a BUSD wallet helps you make BUSD transactions.

All BUSD wallets have private and public keys. A private key is your wallet password, which should always be kept private. Your private keys give you total control over your BUSD; if exposed, you risk losing your BUSD to hackers. It’s just like your fiat bank account that has a password.

On the flip side, a public key is your wallet address, which allows you to receive BUSD from others.

Investing in BUSD

If you aren’t a fan of storing USD in fiat banks, investing your fiat in BUSD may be a better choice.

How to Buy BUSD

P.S: Before rolling out funds to buy BUSD, determine the amount you’re willing to invest in the coin.

1. Choose A Verified Crypto Exchange Platform

A crypto exchange platform allows you to buy and sell any cryptocurrency, and BUSD is no different. You can buy BUSD on global crypto exchange platforms like Binance, Coinbase, Kraken, BitFinex, etc. Some crypto exchange platforms also offer wallets to help you store your BUSD.

2. Fund Your Account On The Crypto Exchange Platform

Just like depositing money into your bank account to buy goods and services, you’ll also fund your crypto exchange account with fiat to buy BUSD. Once you do this, you can proceed to buy BUSD.

3. Buy BUSD

After funding your crypto account with your desired amount of BUSD, proceed to buy. To buy BUSD, navigate to the “buy” or “market” section on the crypto platform, enter BUSD, and input the quantity you wish to buy. Voila! You now have the digital version of USD.

How to Sell BUSD

Want to sell your BUSD for fiat? Or for another crypto of choice? Then follow these steps:

1. Choose A Verified Crypto Exchange

Remember how you bought BUSD? The same applies here, and you need a crypto exchange platform to sell your BUSD.

However, if you aren’t selling BUSD on the crypto platform you bought it on, you need to transfer the BUSD to the platform you want to sell it on. After this step, you can proceed to the next step.

2. Send Your BUSD to the Crypto Platform

This step only applies if you plan to sell your BUSD on a different platform from the one you bought it from. Transfer the BUSD into the wallet of the crypto platform.

3. Connect Your Fiat Bank Account

Remember how you had to send money to buy BUSD on the crypto exchange platform? You’ll do the opposite by linking your fiat bank account to the crypto platform.

However, some other crypto exchange platforms have a fiat wallet automatically generated once you complete your KYC verification. You can then transfer your fiat into your preferred fiat account without necessarily having to link the account prior.

4. Sell Your BUSD for Fiat

Now it’s time to sell. If selling directly to the crypto exchange, navigate to the “market” or “sell section” to sell the BUSD for your preferred currency. If selling via p2p, navigate to the p2p section.

5. Withdraw the Fiat Into Your Bank Account

After selling the BUSD, you can withdraw the fiat amount into your bank account.

Risks and Benefits of Investing in BUSD

Investing in BUSD carries a certain level of risk, and it’s essential to conduct thorough research and weigh your risk appetite before putting your funds in the stablecoin.

Here are some risks and benefits to consider:

Benefits of Investing in BUSD

- Stable price: One of the most alluring things about BUSD is its stability. Unlike other cryptocurrencies with high volatility, BUSD maintains a regular stable price, irrespective of bullish or bearish runs in the crypto market. This makes it risk-free for investors who want to hold the stablecoin long-term.

- Fast Transactions: BUSD transactions are processed instantly. There’s no hashing or minting involved like with Bitcoin or Ethereum. Instead, transactions are carried out via smart contracts, often in seconds.

- Ease of use: BUSD can be easily used within the Binance crypto ecosystem. It provides an easy way to transfer value and use different services within the platform, such as hedging other cryptocurrencies or building decentralized finance (DeFi) applications.

Risks of Investing in BUSD

- Centralization: BUSD goes against the underlying basis of crypto. It is regulated by financial institutions, discouraging transparency and making it prone to mismanagement. Plus, Paxos has the authority to close accounts, just like how traditional bank accounts operate. Truthfully, this can be quite scary.

- Counterparty risk: Because BUSD is centralized and backed by the US dollar, there’s a risk that either Paxos or Binance could default on its obligations. If either party ever face financial difficulties, it could impact the value and stability of BUSD.

- Liable to malicious attacks: The “off-blockchain” bookkeeping and auditing of BUSD makes it liable to hackers. Intruders can easily hack the central institutions responsible for managing transaction records and disrupt the system.

Conclusion: BUSD and the Future

No bussin it, but BUSD remains a legendary achievement in the evolution of digital currencies.

Backed by reserves, BUSD has provided more stability to the crypto ecosystem and offers a reliable and transparent bridge between digital assets and traditional fiat currencies.

Looking ahead, BUSD seems promising, and its stability makes BUSD attractive to investors, traders, and business owners. Plus, BUSD’s compatibility with major blockchain platforms, like Ethereum and Binance Smart Chain, increases the chances of integrating it within decentralized finance applications.

As crypto gains widespread adoption, stablecoins like BUSD would help facilitate seamless global transactions and broader financial inclusion.

With a future as bright, it’s best to stay on the lookout for BUSD and other coins. WAGMI!